The best funding rounds are smooth and efficient, and your legal team helps make that happen. Fundraising is based on valuation, and valuation is based on assets and liabilities, including legal liabilities. No team member is more critical to your fundraising success than your General Counsel (GC).

The key to a smooth and efficient closing for the financing round starts with organization and responsiveness from your legal team. A good lawyer (with good tools) will gather all the relevant information quickly and comprehensively.

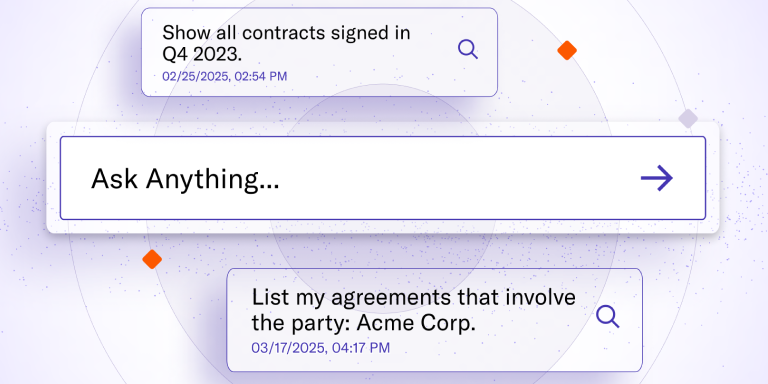

As a part of the process, investors undertake due diligence to verify certain aspects about your business (valuation, assets, liabilities, etc.). Most organizations utilize a data room containing documents evidencing your assets, liabilities, and critical business information (but protected, hopefully, by a firm NDA) that the investor can access. A strong GC will use technology to streamline the process of populating the data room and organizing responses to the investor’s requests to help the deal get to closing as quickly as possible. Watch this webinar to learn how we used LinkSquares to populate the data room in less than 3 business days, instead of weeks

You can pay an outside counsel to look up and organize anything you don't have handy, but your GC can find these items faster and analyze them to make sure that all material items are disclosed without cluttering up the responses with immaterial or unresponsive documents. Here are the 5 questions your GC can answer to help guarantee that your company closes a funding round with minimal disruption in the shortest possible time.

1. Consents Needed to Raise a Funding Round?

It is critical to understand whether any of your agreements have language that would require you to obtain the consent of a third party prior to entering into a financing or other strategic transaction. Any agreement you've already signed -- from IP licensing to previous fundraising documents to regulatory restrictions -- may include language that can meaningfully impact or delay your fundraising process.

You need to know of any restrictions or conditions on the amounts of money you're allowed to raise, the parties from whom you're allowed to raise, or whether any government or regulatory approvals are needed before fundraising starts. Your GC is the best person to assess whether any consents are needed and should be planning ahead to ensure that obtaining third-party consents doesn’t delay your ability to close on time.

2. What Financial Obligations Might Affect Your Valuation?

Your Chief Financial Officer (CFO) will no doubt have a lot to say about your financial liabilities, assets, and projected cash flow. But your GC will have a lot to contribute to your fiscal disclosures, as well.

For example, how much are you contractually obligated to spend, on what/with whom, and when? Lots of companies commit to certain product or service improvements with major customers. When are those commitments due, and what do they entail? Under what conditions can you (or the customer) get out of those obligations?

Many startups take investments from government or non-profit "innovation" funds designed to spur employment in certain industries or locations. What strings come attached to those deals? How does your use of those incentives complicate your tax position? Your GC can help map out all the fiscal impacts of your various contracts.

3. How Secure Is Your Intellectual Property?

If your valuation is based on intellectual property -- be it software, content, or both -- then you need to demonstrate that you have a firm hold on that IP. Do your employees retain rights to their "inventions," or are they all assigned to the company? Has every employee signed an IP assignment agreement? Your GC needs to show that these issues are buttoned up.

While most companies have a good handle on the IP they develop in-house, that's not the complete list of intellectual property concerns. How much third-party IP is included in your products and services, and are your rights to use them secure? This isn't just software, but images, music, written content, the right to use celebrity names and likenesses, and even the right to list your key customers' names and logos on your website. Your GC is expected to provide all relevant licenses and permissions in the data room.

4. How Secure is Your Revenue Stream?

If your company charges a subscription for its products or services, then your GC has a lot to say about any projected future revenues. For example, how much of your recurring revenue is "locked in;" can customers terminate for convenience at any time? If your contracts don't auto-renew, what is the timing of those potential terminations; is there a "churn bomb" waiting in the near future? If you don't have customer lock-in, what is your renewal rate, as demonstrated by explicit renewals (or even upsells) of existing customer contracts?

You can't promise growth if you can't show how much of your present revenues are contractually guaranteed to endure.

5. What Shareholder Rights Can You Offer?

When you get a term sheet, the investor isn’t just looking to acquire shares. The investor will be seeking additional protective provisions and other rights associated with the financing. Your GC should be able to clearly explain the real-world business impacts of any requests for additional investor rights, as well as how granting those rights could impact future transactions (M&A, next round of financing, etc.).

For example, what is the conversion rate for preferred stock to common stock? Did that conversion rate change from the last round? What is the timing and amount of the refresh of the employee option pool, and how does that affect existing vs. new investors? Are there any blocking rights, board seats, or other rights that could impact the future of the business?

In anticipation of getting the term sheet from your dream investor, you should know what rights you are willing to accept and how this round will impact your business moving forward. A good GC will walk you through those things in a clear and concise way so you can negotiate with your investor from a position of knowledge and strength, agree with the investor on the rights upfront, and provide an easier path to a final agreement when it comes to drafting the documents and ultimately, lining up the close.

Legal teams do more than just draw up term sheets, they run your diligence efforts, build your data room, and analyze your required disclosures to ensure the due diligence phase of fundraising goes faster and has fewer surprises. If you want to guarantee your fundraising efforts generate the best deal with the fewest headaches, your GCs is your secret weapon.

LinkSquares makes it possible for your GC to build a data room and respond to due diligence requests in days, not weeks. Contact us today to learn more.

Subscribe to the LinkSquares Blog

Stay up to date on best practices for GCs and legal teams, current events, legal tech, and more.