Legal can’t overlook liabilities during contract negotiation – even when you're trying to close a deal with a strategic customer. That said, there are times that the deal simply needs to get done. Here's what you need to know to manage and mitigate risk while finalizing agreements.

Minimizing Unlimited Liability

Unlimited liability clauses establish scenarios where a party's liability to its counterparties is uncapped. These typically cover egregious contract breaches or scenarios stipulated under applicable law where a person's liability is unlimited. It's generally good practice to standardize agreements and minimize situations where you grant customers unlimited liability. Always be aware of the potential losses facing your business in a contract breach; if you don't, the losses to your business could be staggering.

The best way to limit liabilities under a contract is to:

- Exclude liability for certain types of loss through the exclusion of liability clause.

- Establish a financial cap on liability for such losses through a limitation of liability clause. The limitation of liability, exemption, or exclusion clauses seek to limit or exclude a party's liability or the counterparty's rights or remedies.

Accepting Unlimited Liability

It's not uncommon in early-stage companies and startups for large customers to insist on unlimited liability. However, because it's a complex subject, many people don't familiarize themselves with it enough to understand how it can impact the business.

It may be tempting for a young company to approve an unlimited liability request, but knowing the implications is essential. If you're negotiating a contract with a strategic customer, you need to consider who has the most leverage. So, if the customer is in control, I'll only say “yes” if I have to.

Negotiating Limitation of Liability

The limitation of liability clause is a critical contractual tool designed to manage overall risk by limiting a party's potential liability for damages. This clause is an important term in a contract and should be carefully reviewed and understood.

You'll see it a few ways: Where either indirect, special, or consequential damages are excluded. Indirect damages are hard to calculate. It means, for example, loss of business reputation or loss of future profits. As you can imagine, that can be a huge number. So the limitation in that case may be that you can only collect direct damages for a set number, such as no more than the value of the contract.

I'll agree to the unlimited liability of direct damages, no problem. I know what those will be. You can calculate that. But if I don't have a provision for indirect damages - then that's not something I'll accept.

There are exceptions where it's difficult to prove direct damages, such as IP ownership rights and breach of confidentiality. Those situations need to be thought through carefully.

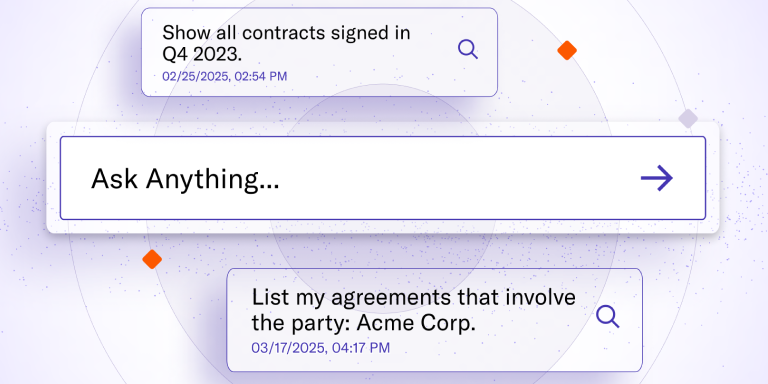

Mitigating Risk with LinkSquares

With LinkSquares AI-powered data extraction, you can quickly and accurately surface critical contract language. If you’re ready to write better legal agreements, close deals faster, and understand every aspect of every contract, schedule a demo of LinkSquares today.

Subscribe to the LinkSquares Blog

Stay up to date on best practices for GCs and legal teams, current events, legal tech, and more.