To avoid the tedium and process errors that come with manual renewals, subscription-based SaaS companies have implemented auto-renewals. Auto-renewals allow companies to collect payments regularly — monthly, quarterly, or yearly — to generate predictable income and forecast accurately.

While they’ve introduced ease into the payment collection process, auto-renewals are not a set-it-and-forget-it. Like any other business activity, they must be tracked and adjusted to reflect any changes in goals, workflows, and pricing. If you don’t monitor your auto-renewals regularly, they can become a source of revenue leakage.

What Is Revenue Leakage?

Revenue leakage happens when a business loses hard-earned money due to operational inefficiencies. One of the most common causes of revenue leakage is unpaid invoices, but poor contract management can also be a major culprit.

Legal operations, the function responsible for helping legal shed its reputation as a cost center, can add value to the bottom line by addressing the contract management inefficiencies that lead to revenue leakage.

Monitoring Auto-Renewals to Stem Revenue Leakage

Auto-renewal payment terms provide recurring revenue for subscription-based businesses but aren’t foolproof. For one, your revenue collection system needs to be functioning optimally at all times, or else you might find that you’re not taking in the payments you’d anticipated. This will lead to cascading issues like inaccurate forecasting and missed targets.

Legal operations teams get ahead of the problem by adequately monitoring auto-renewals to ensure that there are no kinks in the process. Here are some ways your team can stay on top of auto-renewals to minimize revenue leakage.

Standardize Auto-Renewal Clauses

Variations in auto-renewal clauses in your contracts can make it easy to overlook glaring issues. This problem can arise when your business doesn’t have a standard way of generating contracts (that doesn’t include being micromanaged by legal.)

By standardizing your contract creation process, you can better understand your auto-renewal terms — including dates, how far in advance to cancel, and renewal prices — across contracts.

Set Alerts for Upcoming Renewals

Even with standard auto-renewal clauses, there are variations in term lengths. As a result, legal operations, sales, and customer success still need to keep a finger on the pulse of when terms are due for renewal.

Set alerts or create a report that tracks which customers are due to renew and when. This will allow your teams to work together to ensure those customers have everything they need to keep doing business with you.

Use CLM to Track Auto-Renewals

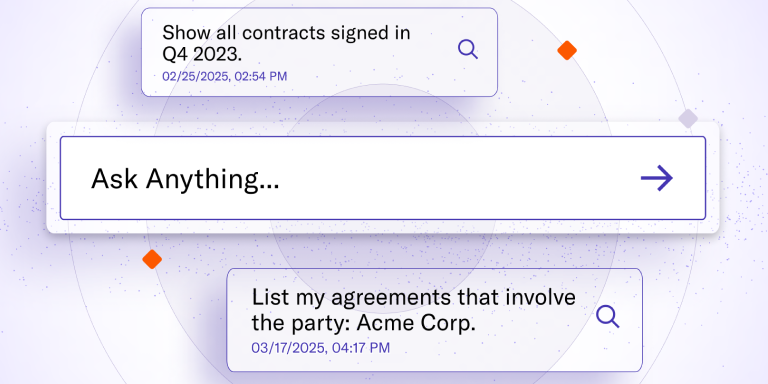

A contract lifecycle management (CLM) solution comes in clutch for auto-renewals. In addition to enabling alerts for customers due for auto-renewal, LinkSquares CLM allows you to search your contract repository for upcoming renewal dates so you can get ahead. Pull reports and create dashboards to get a big-picture overview of auto-renewal and contract termination dates.

Takeaways

Auto-renewals can cause more headaches than prevent them if they aren’t monitored effectively. A modern, AI-powered CLM helps you stay on top of key dates, ensuring you never lose revenue from improperly managed auto-renewals.

See it in action — request a demo of LinkSquares today.

Subscribe to the LinkSquares Blog

Stay up to date on best practices for GCs and legal teams, current events, legal tech, and more.