Many legal teams adopt contract lifecycle management (CLM) software for a variety of reasons, but one of the best and most overlooked motives is to reduce business risk. Below, we lay out three areas where your CLM rollout can do the most to mitigate risks to your business.

There are three general benefits to CLM adoption:

- Deal acceleration

- Increased efficiency

- Decreased risk

Most companies calculate the ROI of CLM software via item two: increased efficiency and decreased costs. If it takes less time to draft and review contracts, it's easy to calculate a return on investment simply from hours saved. You can even reach a revenue increase figure derived from a decreased time-to-close on sales deals, because if deals take less time to complete, you can get more deals done in any given workday, week, quarter, or fiscal year.

Risk is a harder value to quantify, but reducing it can have the biggest impact on your business. Here's how.

Standardized Contract Language

The easiest way to minimize business risk originating out of the legal department is to minimize the variety of language appearing in legal documents to which your business is a party. Life gets easier if your governing law clause always cites Delaware as your jurisdiction, your payment terms are always net-30, and your force majeure clause no longer includes the words "pandemic" or "outbreak" as grounds for termination.

While 100-percent contract standardization is improbable – certain clients and vendors will always have leverage to negotiate unique terms – a good CLM platform will help you minimize non-standard contract language by ensuring every legal agreement goes through the same workflows and begins from the same templates. And if any non-standard language is approved, your CLM can account for it, so you always have a good sense of how much variation – and risk – you're introducing into your business contracts.

Automated Contract Review & Auditing

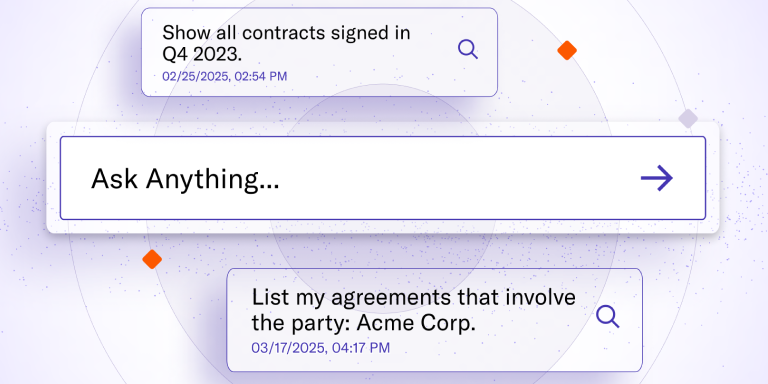

With the advent of natural language processing (NLP) AI, modern CLM suites can automatically review contracts for non-standard language, helping you get a handle on risk. Moreover, these reports can drill down into specific contract risks, such as the number of contracts up for renewal in a given quarter, or the number of agreements with conditional clauses -- often triggered by certain market prices, interest rates, or other business outcomes like sales or mergers -- that can be invoked under present conditions.

Automated contract review decreases costs spent paying paralegals to review your contract repository. It also decreases risk by allowing you to conduct the reviews faster and with the consistency and accuracy of modern software.

Centralized Contract Reporting

How many deals did your legal team assist on last month, and what was the average turnaround time? Is your standard liability cap being negotiated up more often than this same time last year, or less? How many customers have yet to sign your amended terms of service, and how long is it taking to get those amendments executed? These are just some of the figures that demonstrate potential risks to your business.

A good CLM suite can not only help you craft reports that identify and track areas of quantitative risk, it can run those reports on a regular basis, keeping you in regular touch with the risk-related KPIs you care about most.

A modern contract lifecycle management solution, when implemented correctly, can not only reduce costs and increase revenue, it can also minimize your risk profile.

If you're ready to roll out the best CLM suite to get your business risks under control, contact LinkSquares today.

Jay Garmon

Jay Garmon is a product development expert with over 20 years of experience across AI, legal tech, fintech, healthcare, and mobile apps. You can visit him on LinkedIn.Subscribe to the LinkSquares Blog

Stay up to date on best practices for GCs and legal teams, current events, legal tech, and more.