By now, most companies have heard about the Financial Accounting Standards Board Accounting Standards Update called "Revenue from Contracts with Customers". This standard removes general accounting inconsistencies and provides companies throughout different industries with a more robust framework for analyzing revenue.

Why is this important and why should you make sure you’re prepared for these changes?

Simply put, lack of compliance could inevitably lead to some pretty hefty tax penalties for certain enterprises whose revenue structures are complex. Take technology companies as an example. It’s very common within tech companies, who are providing both services and software licensing, to run into potential revenue reporting issues.

A company might charge an implementation fee in addition to their software platform. So, there are really two costs: one for services that are purchased over the course of the year (usually on a month-to-month basis), and the other for an implementation or onboarding cost that may happen within the first 30 days of the contract.

It’s important for companies to differentiate services, and know exactly when they provided them and when they were paid for them so as not to create any tax issues. Luckily, the new standards come with a five-step process for recognizing revenue.

Step 1. Identify The Contracts With Customers

This first step seems simple enough, right? I mean, we all know what a contract is. It turns out determining when you have an actual contract may be worth a quick review.

Under these new guidelines, a contract is defined as “an agreement between two or more parties that creates enforceable rights and obligations.” The FASB was slow in deciding whether a contract had to create legally enforceable rights and obligations. At the end of the day, they decided that enforceability is “a matter of law.”

With this in mind, once you’ve determined a contract is within the scope of the new accounting standards, your next step is to recognize contracts with specific customers. Under the new standard, in order to be a contract for accounting purposes, you’ve got to determine whether it is likely you will collect the contract price. This decision will be based on your customer’s ability and intent to pay.

In this first step, you must also ensure the following five elements have been met:

- Approval and commitment of the parties – Approval can be written, spoken, or in accordance with regular business practices. For instance, if a company provides customer support for a year, and after that year, this service automatically renews each year unless the customer cancels within 30 days of the renewal, then the new contract would be created automatically once the cancelation window passed.

- Identification of the rights of the parties.

- Identification of payment terms – Previously, payment terms were required to be fixed or determinable under the old GAAP accounting standards. But the new standards allow variable consideration. (see step 3: “Determining the Transaction Price.”)

- The contract has commercial substance – In this instance, commercial substance means the risk, timing, or amount of the company’s future cash flows could change as a result of the contract.

- Probable Collection – Is the collection of revenue likely to occur? After going back and forth over whether collectability would be a requirement, the FASB finally decided that if, at inception of the contract collection wasn’t likely, then no contract existed.

How should contracts that don’t meet these criteria be handled?

Contracts that don’t meet these requirements should be reassessed until all requirements are met. Any payments received by a company before the criteria has been met should be recognized as a liability. ASC 606-10-25-7 provides the following two events that trigger revenue recognition if a contract never meets the criteria for a contract:

- The entity has no remaining obligations to transfer goods or services to the customer, and consideration has been received and is nonrefundable.

- The contract has been terminated, and the consideration received from the customer is nonrefundable.

The bottom line is, this first step is very important because if a contract is not legally enforceable or does not meet the new requirements, then revenue recognition is delayed.

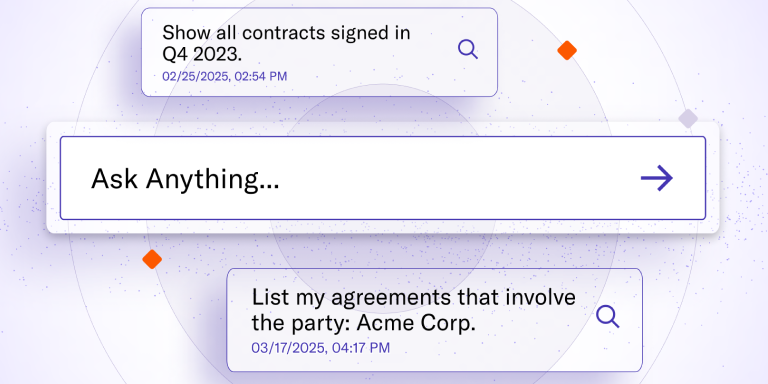

So how can LinkSquares help in this area? As a single centralized secure storage repository for all contracts, LinkSquares search technology will allow you to easily locate each contract and the information within quickly. It will help you quickly identify the right parties and the right payment terms for those parties so you recognize which customers are potentially subject to these revenue recognition changes. You can also sort contracts by customer groups for more detailed review.

Step 2. Identify the Performance Obligations in the Contract

This next step is a bit complicated and may require your legal and accounting teams to adjust some internal processes. As defined in 606-10-05-4, identifying performance obligations consists of identifying distinct goods and services promised to a customer. This promise can be implied or explicitly stated within the contract.

It’s incredibly important that these obligations can be identified because they can affect when and how much of the allocated revenue of each identified performance obligation should be recognized. Of all the factors that can impact when recognition occurs, time frame is a biggie. The standard states that allocated revenue for a performance obligation may be recognized over a period of time (as opposed to at a specific point in time), so long as the obligation satisfies certain criteria.

One such criterion is that the contracted party’s “performance creates or enhances an asset (for example, work in progress) that the customer controls as the asset is enhanced or created.”

How Should Tech Companies Recognize Revenue From Intellectual Property?

Licenses on intellectual property are a specific type of performance obligation worth mentioning. How you recognize revenue depends on various factors. One of the most important factors is what type of intellectual property, functional or symbolic, does the license cover?

- Functional intellectual properties

A license for these types of properties allows customers to use the intellectual property without the need for continuous maintenance or support from the licensor. An example of this would be accounting software. Since the licensor does not have to provide ongoing service during the license period, revenue from the property may be recognized at a specified point in time.

- Symbolic intellectual properties

These types of properties include things like sports team names, brands and logos. In these instances, the licensor is obligated to continuously maintain the value of the property during the license period. Given these ongoing responsibilities, revenue from this type of license is recognized over a period of time.

As you can already tell, identifying all of the services you’ve agreed to provide each customer can become quite complicated and time-consuming. In order to remain compliant, you’ve got to have a simple, streamlined process for understanding the particular details of what exactly is in each of your contracts.

LinkSquares uses a full-text search engine that allows you to identify particular terms in contracts. You can then export that data into a CSV with one simple mouse click, to gather a comprehensive report. With all data pertaining to the obligations section for each of your contracts, you can save hundreds of hours reviewing contracts. Find out more about how you can cut down contract review time here.

Step 3. Determine the Transaction Price

What is the transaction price exactly? It is the amount a customer promises to pay for goods or services and is the basis for measuring revenue. The transactional price is affected by the nature and timing of consideration to be received, but excludes third-party collections like a sales tax.

In the last step, you identified your performance obligations, this next step identifies the amount allocated to those obligations in a contract and, thus, the amount of revenue to be recognized once they are satisfied. In many cases this step will be straightforward and you will simply be recognizing revenue based on a fixed amount the customer pays at the time of sale.

However, there are some transactional pricing complexities to be aware of. One of the biggest changes in the standard is the treatment of variable consideration, which accounts for factors such as volume and prompt-payment discounts, rebates, royalties, incentives, and contingencies (e.g., returns). In the past, companies could use estimates to determine the impact on revenue recognition, and current accounting principles require only that the variable revenue amounts be recognized only when the circumstances making them variable are resolved.

The new standard requires the seller to determine the likelihood that variable revenue will ultimately be realized. If the likelihood is probable, then that revenue should be included in the transaction price.

This is only one change that could lead to potential complexities, but there are plenty more. But these changes to transactional pricing don’t have to cause you too many headaches. This is where LinkSquares comes in.

The software allows you to easily search and report on specific text around contract pricing. This will typically be found in the licensing or subscription sections of the contract. Search multiple contracts at the same time, pull information into a CSV file, analyze in seconds.

Step 4. Allocate the Transaction Price to the Performance Obligations in the Contract

In this step you’re taking the transaction prices identified in step three and allocating them among the performance obligations identified in step two. This allocation is based on the prices charged for goods and services when sold separately. When performance obligations are “packaged” and do not have standalone prices, then the company should estimate the allocation amounts using one of the following:

- Market prices

- Cost plus expected margin

- Residual prices - Package price minus the sum of other obligations that do have standalone prices

What about discounts?

What is your company’s history with offering discounts? You’ll want to take this into consideration when allocating transaction prices for bundled goods and services. But be aware, under the new standard, it may not always be appropriate to allocate a portion of these discounts to every item in your bundle.

Finally, the transaction price allocation is determined at the inception of your contract and cannot change later as standalone selling prices are updated. So, for example, should your company roll out its annual pricing update after the contract has started but prior to completion, no reallocation is necessary.

As we mentioned in the beginning of this blog post, it’s really important, particularly for technology companies, who are providing both services and software licensing, to be able to report revenue correctly to avoid getting into tax trouble. LinkSquares is the software platform of choice for many high-growth technology companies, allowing them to stay compliant and ahead of any contract issues.

Step 5. Recognize Revenue When The Entity Satisfies A Performance Obligation

In the final revenue recognition step, companies recognize revenue once they have met the performance obligations to reflect the actual transfer of control over assets sold to customers. What constitutes this control?

Control in this instance means getting and making beneficial use of the product or service. The new standard offers the following circumstances that typically indicate transfer of control:

- The buyer has physical possession, legal title, or significant risks and rewards of ownership.

- The buyer has accepted the asset.

- The seller has an enforceable right to payment.

This step is relatively straightforward, particularly when control of assets transfers at a specific point in time – like upon delivery. This determination can be tricky when control transfers over time, as it sometimes does with intellectual property.

Confused about how to determine if control transfers over time? The standard says YES if any of the following are true:

- The customer receives and uses the benefits of the asset as the seller performs the service (e.g., service contracts).

- The customer controls the asset while it is being created, customized, or enhanced (e.g., work in process for some manufacturing contracts)

- The seller is creating an asset that cannot be redirected to another use or customer and the seller has an enforceable right to payment for work completed to date (e.g., a printer receiving a business card order).

Recognizing revenue from long-term contracts is a significant change for many companies. Tech companies may recognize more revenue upfront, upon initial delivery of hardware and licensing fees, and less revenue over the remainder of the contract as monthly services are delivered.

Step 5 is where many CFO's and General Counsel's find the most value in LinkSquares, because it helps them keep all of their contractual information in one place, and access them easily to search and review quickly when situations like this recent standards upgrade take place. Here are some common use cases for in-house legal and finance teams.

Being able to run the right reports and get needed information to the proper parties – like the executive team or the board – to stay compliant and mitigate legal risks is invaluable.

LinkSquares helps you store, manage, and review your contracts easily so you can save time and money, and handle any new regulations that may come up. Need help with your contract review and analysis? Get in touch with us today.

Subscribe to the LinkSquares Blog

Stay up to date on best practices for GCs and legal teams, current events, legal tech, and more.